Understanding Trading Proprietary Firms: A Comprehensive Guide

In the evolving landscape of the financial services industry, trading proprietary firms have emerged as pivotal players. These firms, often referred to as "prop firms," engage in trading financial securities with their capital, aiming for profitability while also providing opportunities for skilled traders to showcase their abilities. This article delves into the intricacies of trading proprietary firms, their operational frameworks, and the benefits they bring to both traders and the overall market.

What is a Trading Proprietary Firm?

A trading proprietary firm is a company that invests its own money into financial instruments such as stocks, bonds, and derivatives. Unlike traditional trading firms that manage clients' money, prop firms leverage their capital to trade in the market. This model allows them to employ various trading strategies, ranging from algorithmic trading to high-frequency trading, to maximize returns.

Key Features of Trading Proprietary Firms

- Capital Focused: Prop firms trade using their own funds, which can lead to greater risk exposure but also higher potential rewards.

- Traders as Employees: Many prop firms hire traders as employees or offer partnerships, allowing them to use company capital to trade.

- Training and Resources: These firms often provide extensive training, tools, and analytical resources to help traders refine their strategies.

- Risk Management: Proprietary firms implement stringent risk management protocols to protect their capital and optimize performance.

The Evolution of Proprietary Trading

The concept of proprietary trading has roots that trace back several decades. Initially, banks and financial institutions engaged in proprietary trading to enhance their earnings. However, as the market became competitive and the landscape shifted, dedicated trading proprietary firms began to flourish. The rise of technology and the internet has further accelerated this growth by enabling faster access to market data and execution platforms.

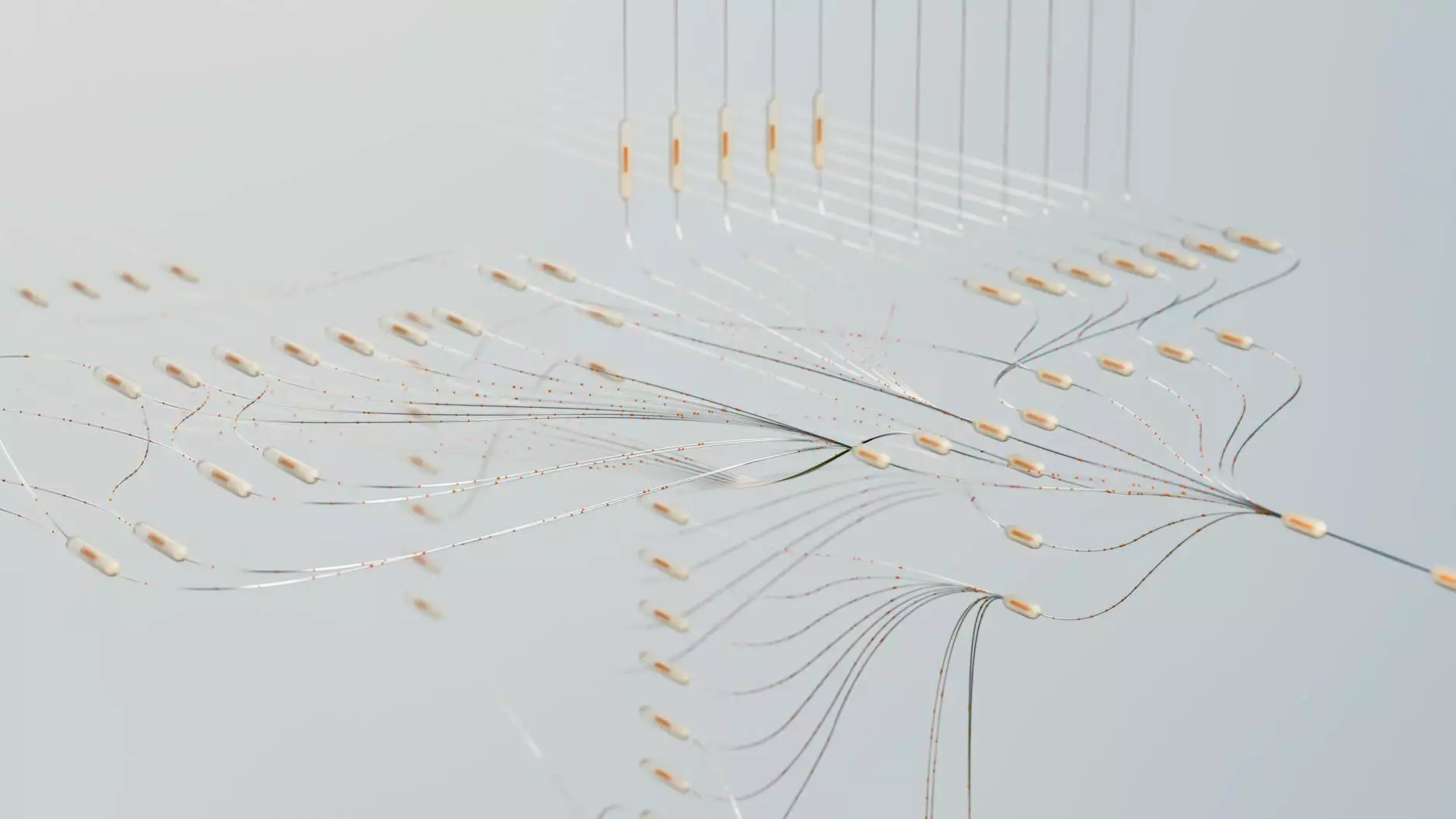

The Role of Technology in Proprietary Trading

Today's prop firms heavily rely on technology to trade efficiently. High-frequency trading (HFT) is a prime example of how technology has transformed the trading process. It allows firms to execute numerous orders at extremely high speeds, capitalizing on minute price discrepancies. Moreover, the use of advanced algorithms and AI has enabled traders to analyze market data and execute trades with precision.

Benefits of Trading Proprietary Firms

Traders and investors can experience numerous advantages when engaging with a trading proprietary firm. Here are some compelling benefits:

1. Access to Capital

For traders, one of the most significant benefits of working with a prop firm is access to capital. This allows experienced traders to increase their trading volume without risking their personal finances. As a result, they can employ more aggressive strategies and leverage their skills for greater profits.

2. Advanced Trading Tools

Proprietary firms invest heavily in state-of-the-art trading platforms and analytical tools. Traders at these firms gain access to cutting-edge technology, which can greatly enhance their trading capabilities. Whether it's advanced charting software, market analysis tools, or risk management systems, traders benefit from the resources provided by their firms.

3. Support and Training

A key differentiator for trading proprietary firms is the emphasis on trader development. Many firms offer comprehensive training programs designed to sharpen trading skills. These programs may include mentorship from seasoned traders, simulations of market scenarios, and access to live trading sessions.

4. Risk Mitigation Strategies

With capital at stake, trading proprietary firms implement robust risk management protocols. These strategies include setting limits on trades, diversification across asset classes, and utilizing hedging techniques. For traders, this structured approach not only protects personal capital but also fosters a disciplined trading environment.

5. Performance Incentives

Proprietary trading firms often offer lucrative incentives based on performance. Traders can earn a percentage of profits they generate, encouraging them to perform at their best. This pay-for-performance model aligns the interests of traders and the firm, fostering a culture of excellence.

How to Choose a Trading Proprietary Firm

When considering joining a trading proprietary firm, it's essential to choose the right partner. Here are several critical factors to contemplate:

1. Reputation

Research the firm's reputation in the market. Look for reviews, testimonials, and track records of success. A firm with a solid reputation is likely to provide a better trading environment.

2. Training and Resources

Evaluate the quality of training and resources offered by the firm. A robust training program can significantly enhance your skills and trading strategies.

3. Fee Structure

Understand the fee structure of the firm. Some firms may charge a monthly fee, while others might take a share of your profits. Ensure that the fee alignment is suitable for your trading style and goals.

4. Risk Management Policies

Assess the firm's risk management policies. Ensure that they have structured protocols in place to protect both traders and the firm's capital.

5. Company Culture

The culture of a trading proprietary firm can greatly impact your experience. Look for a firm that fosters a collaborative and supportive environment, encouraging traders to share ideas and strategies.

Conclusion

In conclusion, trading proprietary firms represent a compelling opportunity for skilled traders to elevate their careers while contributing to the financial markets' dynamism. By leveraging their capital, providing advanced trading tools, and fostering a culture of growth and collaboration, these firms play an integral role in reshaping the trading landscape. As the financial services industry continues to evolve, understanding the benefits and operations of prop firms is essential for any trader seeking to thrive in a competitive environment. Whether you are an aspiring trader or a seasoned professional, aligning with a reputable trading proprietary firm may just be the key to unlocking your full potential in the world of trading.

For personalized IT services and comprehensive financial advising, be sure to explore the offerings at Bullrush.com. Their insights and professional guidance can help you navigate the complexities of today’s financial landscape.